Introduction

Bad debts and debt collections are considered some of the challenges that poses a threat to business, ultimately affecting business profits and cash flows. When a customer fails to make any payment, it leads to bad debts, resulting in revenue losses and excruciating financial health. This gives rise to the stringent debt collection process.

“The market size of the global B2B debt collection amounted to USD 4.3 billion and is expected to grow at a 7.6% CAGR, reaching USD 7.75 billion by 2033.” – Business Research Insights

In modern times, collections are not limited to just sending letters and making calls. It is more about focusing on data and predicting the credit risk, identifying inaccuracies, and enhancing customer experience. A “nice to have” technology is a “must have” in every business, i.e., artificial intelligence (AI). This technology provides assistance to the collection teams by prioritizing B2B accounts based on risk involved, leading to quick resolutions and avoiding messed-up situations.

What is B2B Debt Collections?

Meaning

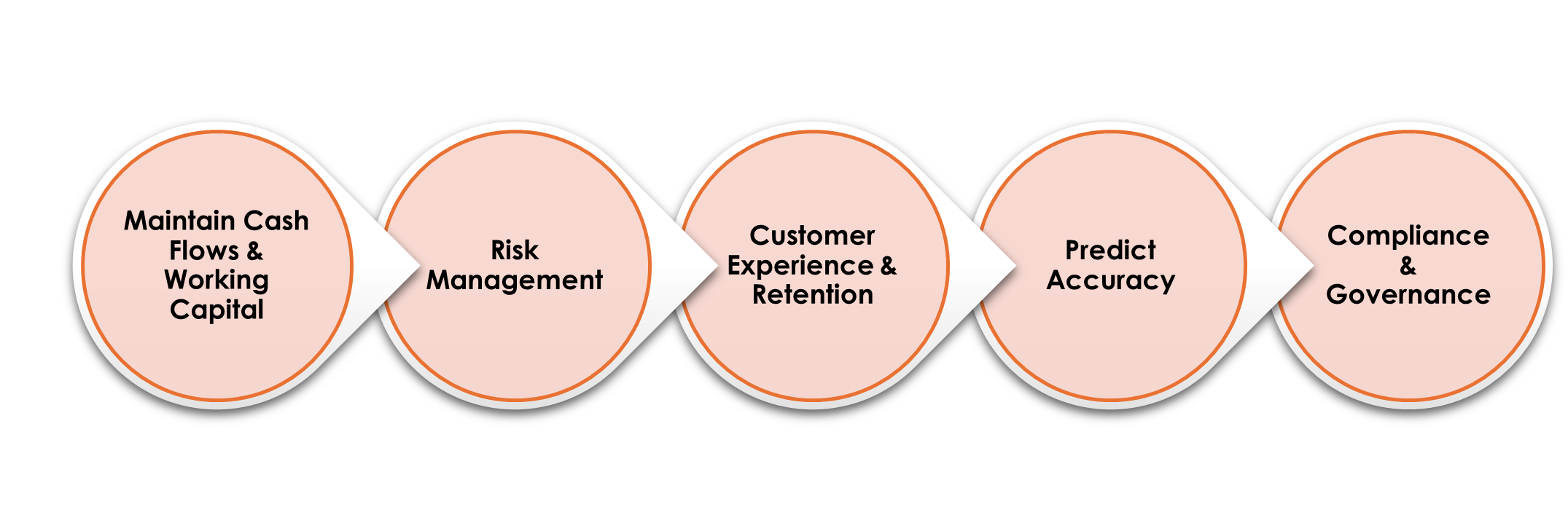

B2B debt collection is an end-to end process that is used by the businesses to recover payments from other businesses for the provided goods and services. This process includes invoice issues, credit requirements, negotiating terms, and escalating past-due accounts. This also includes maintaining compliance with the applicable regulations and preserving customer experience. The ultimate goals here are to promote cash flows, minimize bad debts, and boost the sales.

Importance of B2B Debt Collections

Why “now” matters?

With technological advancements, businesses focus more on streamlining their operations. AI is now more than just an additional feature and has become a necessity. This includes:

- Data is the key. From customer relationship management (CRMs) to seamless payment channels, AI brings every segment of B2B debt collections together by combining data and minimizing the involvement of humans.

- Customer expectations are constantly changing. Customers want omnichannel and personalized experiences, including for payables. With AI, businesses can predict customers’ requirements and provide what they want.

- Irregularity is the new base. Established rules fail when credit volume and risk change from time to time. AI models can identify the pattern changes and support cash flows without impacting the customer base.

- Collectors have limited time. AI implementation can eliminate the mundane tasks, freeing up more time for collectors to focus on customer relationships and negotiations.

What does AI actually do in B2B collections?

As we’ve learned about the significance of AI, now let’s demystify the capabilities of AI in B2B debt collections, irrespective of the industries. This consists of:

Account Prioritization

The first and foremost move AI technology makes is to rank the accounts and invoices. Such ranking is done on the basis of payment status (i.e., late, failed, or early payments). Moreover, AI also considers credit exposure, relationship terms, and expected value. This list is automatically updated based on the nature of new collection disputes. It allows the collectors to start with the most significant accounts.

“As per Zipdo’s Education Report 2025, the average collection rate stood at about 21%.”

Promise-to-pay (PTP) Prediction

AI models evaluate the customer payment history to identify which accounts are more likely to break the payment terms and when. This proactive approach allows the businesses to act before credit becomes a bad debt.

Dispute triage and root-cause routing

Natural-language models read emails, PDFs, and portal notes to classify disputes, extract key entities, and route to the right owner with a clean summary. Resolution time drops because informed decisions are made from the first touchpoint.

Anomaly and invoice quality detection

AI technology identifies the abnormalities involved in debtors’ accounts and invoices. This includes spotting incorrect account numbers, mismatched tax, inaccurate addresses, and more. With this technology, such errors can be fixed before acting on them. This allows the businesses to prevent a dispute as it is cheaper than winning one.

“McKinsey’s “The state of AI: How organizations are rewiring to capture value” stated that 78% of the businesses use AI at least in one operation.”

Agent Assists

During calls or chats, AI provides account history, open disputes, prior promises, and suggested talking points. After interactions, it auto-writes notes, updates statuses, and schedules follow-ups. The aim is to ensure that collectors spend their time negotiating and not typing.

Forecasting and scenario planning

Collections forecasting becomes probabilistic. This includes changes in cash flows, staffing, policies, and recovery rates. AI models make sure that instead of focusing on a single Days Sales Outsourcing (DSO) estimate, we must focus on the overall collection strategies. With this, strategic tradeoffs become clearer.

“According to HAI’s Artificial Intelligence Index Report 2025, 49% of the businesses using AI save operational costs.

A practical 180-day roadmap

Days 0–30: Define scope & baseline

- Select 2-3 segments;

- Fix selective metrics and baselines;

- Establish a secure database with an auto-update feature.

Days 31–90: Pilot

- Implement AI prioritization and agent assist for debt collectors;

- Start dispute management for the selected categories;

- Compare promises kept and promises failed out of the total due payments.

91–180: Scale

- Extend to additional segments and geographies.

- Add forecasting and invoice anomaly detection.

- Integrate with payment portals for self-serve resolution and real-time status.

“Market.us’s AI for Debt Collection Market article states that AI in debt collection can improve the collector’s efficiency by 2 to 4 times.”

What Success Looks Like

Strong AI-enabled collections programs tend to show:

- Cleaner queues. Fewer low-value touches and more right-party contacts.

- Fewer disputes and faster resolution because issues are categorized early and routed correctly.

- Better relationships. Messages are respectful, factual, and tailored to how each customer prefers to work.

- More predictable cash. Probability-based forecasts reduce end-of-month panic.

The key is to define outcome metrics up front. Common ones include: DSO, bad-debt write-offs, roll rates by delinquency bucket, right-party contact rate, kept-promise rate, average days to resolve disputes, and cost to collect.

“Sciencesoft’s AI in debt collection article reported that AI-based strategies can minimize the delinquency rate by over 25%.”

Getting your data house in order

AI thrives on signal density and consistency and not perfection. Start with what you have:

- Core tables including customers data, i.e., invoices, payments, credits, disputes, promises, credit limits/exposure, and communications log.

- Documents: Invoices, POs, delivery/POD, contracts/MSAs, remittances, and statement reconciliations.

- Context: Industry tags, payment methods, credit insurance status, regional calendars/holidays.

Build, buy, or blend?

- Buy: If you want a speedy and proven workflow, implement AI to promote off-the-shelf collections, set-up dispute management, and integrate omnichannel outreach into your Enterprise Resource Planning (ERP) and scale quickly.

- Build: If you have specific workflow needs, unusual data, and a platform strategy, it is essential to build a B2B debt collection process with AI. You’ll own the roadmap, but it also carries integration and maintenance costs.

- Blend: This includes buying a workflow strategy and enriching it with your own models.

Common pitfalls (and how to avoid them)

- Boiling the ocean. Start with a narrow and high-impact segment and expand once you’ve proven value and learned.

- Messy ownership. Disputes often span finance, sales, and operations. Establish service-level agreements and escalation paths upfront.

- “Black box” backlash. Collectors and sales need to understand why a score or message was suggested. Provide transparent reasons.

- Neglecting content quality. AI can draft, but you should establish a library of approved templates that reflect your brand and legal posture.

The bottom line

Collections aren’t just about getting paid; it’s about preserving trust while protecting cash flows. AI gives you leverage on both fronts. It enhances your team with sharper prioritization, smarter outreach, faster resolution, and better foresight. In a world where volatility is at stake and talent is limited, then leverage is no longer optional. It’s the difference between chasing your ledger and steering it.

Frequently Asked Questions AI in B2B Collections

1. Will AI replace my collectors?

No. The biggest win is connecting people, automating basic collection tasks, and suggesting the next best actions. AI works as an assistant hand so that collectors can focus on negotiating payment terms and improving customer experience.

2. Is AI helpful if we have a small AR team?

Yes, especially then. The implementation of AI leads to account prioritization, auto-drafted outreach, and dispute management.

3. How do we measure success?

Success of AI in B2B debt collection can be measured by tracking:

- DSO

- Right-party contact rate

- Kept-promise rate

- Dispute resolution time

- Roll rates

- Bad-debt write-offs

- Collection cost

4. Build vs. buy — what’s right for us?

Buy for speed and standard workflows; build for unique needs and internal ML capabilities; blend to get the best of both.

5. How accurate are the predictions?

Accuracy depends on data volume/quality and the stability of your business patterns. Good programs pair models with human review and continuously retrain.

Sources

B2B Debt Collection Service Market

Debt Collection Industry Statistics

The state of AI: How organizations are rewiring to capture value