Why Invest in a Quality Management Solution?

Improved Customer Experience

Gain insights from customer interactions to boost satisfaction and loyalty. Ensure consistent quality for a seamless customer experience

Enhanced Agent Performance

Identify areas for improvement and provide targeted coaching. Monitor performance for timely feedback and recognition.

Operational Efficiency

Streamline processes and reduce costs by identifying inefficiencies. Automate tasks like call scoring and reporting.

Risk Mitigation

Ensure Compliance with regulations and detect fraud early to minimize legal risks.

Data-Driven Decision Making

Leverage data to drive strategic decisions and predict customer trends.

ROI of Quality Monitoring and Analytics Platform

Quantifiable Benefits That Impact Your Bottom Line

20%

Improvement in compliance adherence.

23%

Jump in sales conversions

18%

Reduction in handle

time

25%

Improvement in retention rates

15%

Improvement in collection rate

Why leading enterprises choose NEQQO?

A Solution Backed by Decades of Expertise and Proven Results

Reputation

Success

Companies

Customization

Benchmarking

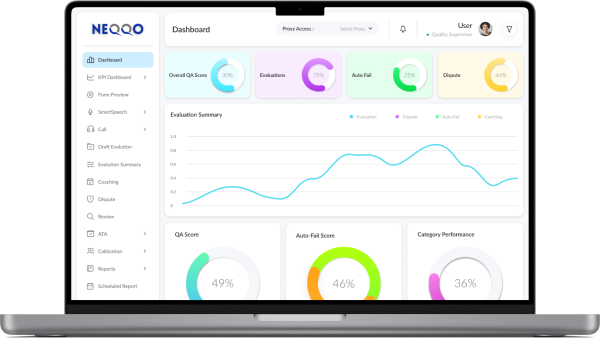

NEQQO – Where Intelligence Evolves into

Not just a platform, a solution driven by Human Expertise

- Depth of Expertise and Scalable Solutions: NEQQO leverages Bill Gosling Outsourcing’s extensive industry experience for large-scale, complex operations, surpassing other QA platforms.

- Industry-Specific Insights and Holistic Approach: Gain tailored insights and a comprehensive solution that integrates robust support, addressing all aspects of quality assurance.

- Backed by Decades of Proven Success: Supported by the operational excellence and reliability of Bill Gosling Outsourcing, ensuring superior customization and customer service.

- Strategic Advantage: Opt for NEQQO to enhance operational quality with a track record of industry leadership and innovation.

A Robust Feature Set for end-to-end quality management

Advanced Tools to Drive Performance, Compliance, and Customer Satisfaction

-

100% Auto-QA through AI

100% Auto-QA through AI

-

Human assisted manual evaluations

Human assisted manual evaluations

-

Personalized AI & Manual coaching for all your agents

Personalized AI & Manual coaching for all your agents

-

Dedicated Insights section for your Key Performance Indicators

Dedicated Insights section for your Key Performance Indicators

NEQQO AI Features

Complete Auto-QA with AI

Achieve 100% quality assurance through advanced AI-driven call analysis and summarization.

Tailored AI & Human Coaching for Agents

Offer customized coaching solutions combining AI insights and expert guidance to elevate agent performance.

AI-Powered Insights Assistant

Leverage AI like ChatGPT to extract valuable data from interactions and quality evaluations, empowering your decision-making.

Lead the Change with NEQQO

Revolutionize your call center with a platform that combines Generative AI, Human Expertise, and Actionable Insights to elevate every interaction and drive success.

Watch the Explainer VideoTestimonials

(QA Manager, Leading British Telecom company)

(QA project coordinator, Leading revenue recovery organization in North America)

(Vendor partner, leading UK Telecom company)

(Manager, strategic planning & operations, North American cloud communications provider)

(BA Quality, Energy delivery company in North America)

(BA Quality, Energy delivery company in North America)

Operational Excellence in Focus: Our Success Stories

Discover Insights and Inspiration in Our Latest Posts

Most Popular Case Studies

100% Auto-QA through AI

100% Auto-QA through AI